Moody's Upgrades India Rating After 13 Years, Betting On PM Modi's Reforms, Markets Up

Moody's Investors Service raised India's sovereign rating for the first time since 2004, overlooking a haze of short-term economic uncertainties to bet on the nation's prospects from a raft of policy changes by Prime Minister Narendra Modi.

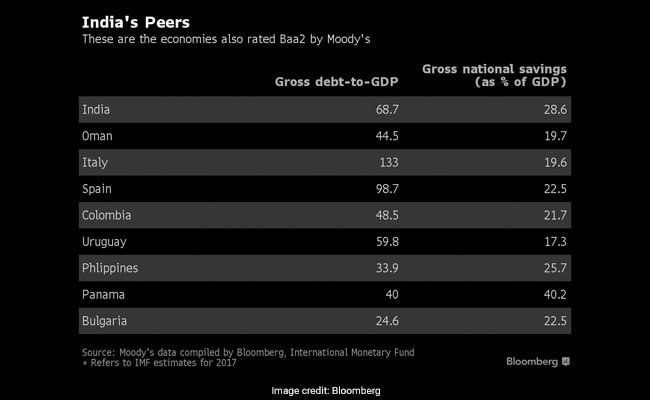

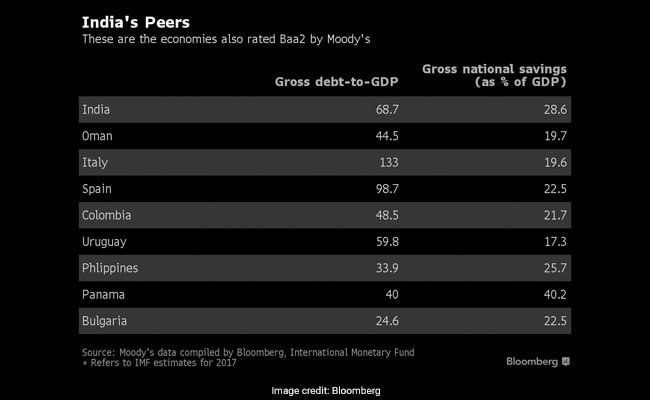

The rupee, bonds and stocks rallied after the ratings firm upgraded India to Baa2 from Baa3 and said reforms being pushed through by PM Modi's government will help stabilize rising levels of debt. That's a one-level shift from the lowest investment-grade ranking and puts India in line with the Philippines and Italy.

"This is an overdue correction," PM Modi's Chief Economic Adviser Arvind Subramanian told Bloomberg Quint, referring to the upgrade. "This is a recognition of India's macro economic reforms. But it has also to be kept in mind that these are external factors. And the government will pursue its own reform agenda. And those will drive our economic development."

Some investors termed it a surprise given that India recently surrendered its status as the world's fastest-growing major economy amid sweeping policy change. The upgrade could prove to be a big win for ruling party BJP, which has faced increasing attacks about the economic slowdown before key elections in PM Modi's home state Gujarat next month.

Some investors termed it a surprise given that India recently surrendered its status as the world's fastest-growing major economy amid sweeping policy change. The upgrade could prove to be a big win for ruling party BJP, which has faced increasing attacks about the economic slowdown before key elections in PM Modi's home state Gujarat next month.

"This is a positive surprise to the markets, especially in terms of timing," said Vivek Rajpal, a rates strategist at Nomura Holdings Inc. in Singapore. "One fear that was developing in the market was debt-flow positioning."

The rupee surged as much as 1 percent to 64.67 per dollar in Mumbai while the yield on the 10-year sovereign bond tumbled 11 basis points to 6.96 percent and the benchmark equity index rose 1.25 percent. Markets have welcomed the move, with the Sensex rising over 400 points on Friday morning at 33,520 and the Nifty gaining 120 points.

Ease of Business

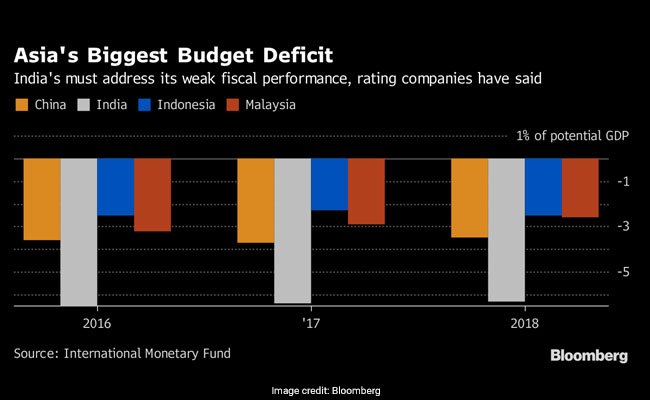

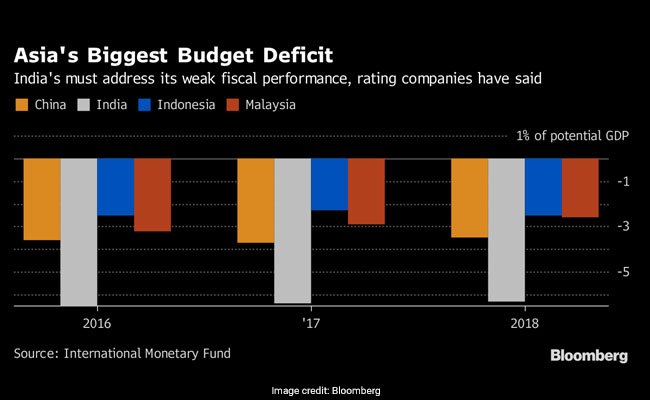

PM Modi has pushed through sweeping reforms, with mixed results. Last year's removal from circulation of almost 90 percent of the nation's currency weighed on growth. Expansion in gross domestic product slipped below 6 percent in the April-June quarter, sparking expectations that the government will need to announce a fiscal stimulus package to boost activity.

Other measures -- such as efforts to cut red tape and the imposition of a new consumption tax -- have met with mixed success. The government won praise from ratings firms for a $32 billion program to recapitalize banks that economists say will revive lending and stoke demand on the ground.

The World Bank has acknowledged it's getting easier to do business in India, with Asia's third-largest economy jumping 30 places to rank 100th in the latest ranking released last month. Earlier this week, Pew Research Center said PM Modi remained a popular leader and public confidence in the economy and the overall direction had improved.

Debt Burden

Moody's cited the goods and services tax, which it said will promote productivity by removing barriers to interstate trade, improvements to the monetary policy framework, measures to clean up non-performing loans, and efforts to bring more areas into the formal economy.

"While India's high debt burden remains a constraint on the country's credit profile, Moody's believes that the reforms put in place have reduced the risk of a sharp increase in debt, even in potential downside scenarios," according to the firm's release.

"While India's high debt burden remains a constraint on the country's credit profile, Moody's believes that the reforms put in place have reduced the risk of a sharp increase in debt, even in potential downside scenarios," according to the firm's release.

With Thanks: NDTV: LINK for Detailed news report. Must view.